On paper, it might seem weird to have a post about a Bank, but, it’s kind of crazy the journey I’ve had with Monzo. Monzo is a UK based bank, though, have since launched in the US as well. It’s what sets it apart that makes Monzo interesting. Naturally, competition has arisen since its initial debut to match, in some ways exceed, what it started, but, it’s still got that little extra you don’t get from the rest.

I remember spending a good few weeks trying to convince my Parents that Monzo even was legit, as, at the time, it wasn’t something really spoken about. Fast forward to today, everyone’s heard of it. We’ve become a family of Monzo lot, in the end. Yes, I did take advantage of their Referral bonus, even if it’s massively increased since the £5 I got out of it.

How did you first discover Monzo?

I discovered Monzo rather accidentally, really. Ironically, here’s an ironic twist to the it’s legit debacle, I first heard of Monzo by someone trying to use the Monzo Me service to scam people. In case you’re unaware, Monzo Me is actually really good. It allows you to pay anyone on Monzo by simply visiting their personal link and paying as if it’s a regular purchase online. So, good feature, but, as with anything, easily abused. But, if used legitimately, it’s safe, useful and secure. In fact, we use it here if you want to Donate to BEHANN.

The benefits of an app-first Bank

One thing that will certainly turn away the legacy, and, even make a few generations after shiver, is the idea of an online only Bank. But, let’s be real, nearly all Banks now are shutting on the high street, and, every reason to need them on the high street is very smaller and smaller by the year. Don’t get me wrong, I’m NOT a supporter of a Cash-less society and a firm believer that it should always remain. But, being a Bank that doesn’t need to deal with the high street… ever, is probably a good reason why the Monzo app experience is so damn good.

I mean, it’s kinda embarrassing for the big guys why their apps look so bland by comparison. Monzo is simple, straight to the point and is very easy to use. Believe me, I’ve been showing my Parents around their other Banking experiences and can say, by comparison, it’s taken a lot less effort to get them around the Monzo experience. One benefit, if you, really do, hate the other Banks experience, you can view your other Banks activity through Monzo. Though, unlike other Banks, there is a bit of a fee to do that, which we’ll get to as there’s quite a number of decent benefits.

My main reason for actually trying out Monzo is traveling to the Philippines. I had a very disappointing experience when I purchased some Airport food on my Barclays card whilst in Qatar, that was fun expensive experience. Now, I don’t mean the Airport food, that’s always expensive, I mean the nice unexpected fees that came along with it. Monzo, essentially, pioneered, certainly, popularised, the idea of having a Bank that offers fee-free ability to spend in any Currency around the world, making this a very beneficial companion abroad. This was massive when it came to my Wedding in the Philippines! In fact, let’s just get to that;

Fee-free wherever you maybe…

No matter whether you’re paying by physical Card, contactless, Apple Pay, or, even ATMs, you will always just be charged the same currency rate per Pounds. And, unlike other Banks, you don’t get charged an additional out-of-currency fee. This means, if you’re ever abroad and the Machine asks for you to pay in UK Pounds or local currency, always choose local currency. You can also use ATMs unlimited in the UK and EEA areas, but, if you need to use them outside of that area, you have a fee-free limit of up to £200 per month, which increases to £600 if you have a paid Monzo plan (more on those later). This limit is only for ATMs and no transactions.

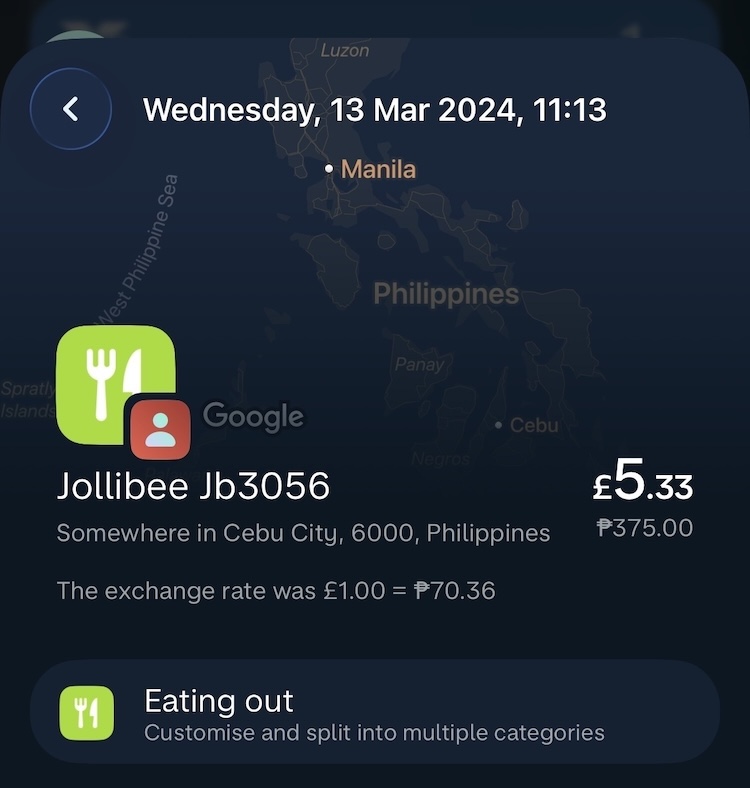

Using the Card abroad is, quite literally, identical to using it anywhere else. It’s an international Mastercard. One feature I actually really like is when you do pay in, let’s keep this example above, Philippine Peso, it will display the amount immediately in British pounds, with the local currency underneath and the exchange rate, so you immediately know how much you’ve actually spent rather than some aimless estimations.

The massive benefit for me was during our Wedding. Naturally, this was taking place in the Philippines, which meant, really, we just did it all there. Rings were purchased there, the Events were paid there, all in local ₱, so Monzo’s lack of additional fees was actually huge.

And international online transactions, too?…

Well, to put it bluntly, yes, it works with those too. This means you can actually purchase anything online in a different Currency and get no additional fees, for doing so. This was actually, and, will remain, massive, when it comes to paying for Hannah’s Visa fees as, even though it’s the UK, these are charged in US dollar.

Free vs Paid – Is it worth it?

For most people, especially if you’re only going to travel, either, lightly, or around Europe, or, not use ATMs too much, you’ll probably be fine without paying a penny for Monzo. The free account still gives you some pretty awesome features and full access to the Bank and its features. But, if you do fancy sharing a few bob, you do get quite a bit for doing so.

If you include “Free”, Monzo has 4 main options for a single user, as well as, then, a Joint account option, Business account and, most recently, completely free Kid accounts. The Paid options “Extra”, “Perks” and “Max”, the all-in option. To give my TL:DR, I’d say 99% of people are best either paying nothing, or going for “Perks”, as “Extra” is a rip off, and “Max” is only for those who need it. Need what? Well, let’s get into the details for a little bit. [Accurate January 2026]

(There’s also another type of Monzo account which I think is one of its best, for free, which we’ll go over after)

You get a lot for nought with Monzo, and, before I go over the paid options, there’s nothing that requires you to pay, to use the Bank as a normal everyday Bank in the UK. One of my favourite Monzo features, which really adds a more Social aspect, is Split the Bill. You can buy something, then, easily by your Phone book, Split the Bill with anyone else you know who is also with Monzo. Or, even if they’re not with Monzo, you can request that money, though, obviously in a less seamless way.

But, if you want to, here’s what a bit “Extra” gives you.

Extra

£3 per month sounds good, until you really look

You get matching Cards when you switch between the Free plans to Paid, with the exception of Extra, which, as I already hinted, is, by far, the least worth it of the options. I mean, sure, you get a bunch of additional features not available for free, but, a lot of them kind of feel like they should be free, if you get what I mean. I mean, here’s everything they brag about Extra, marked in italic, by me, as to whether I think should be Free anyway;

- Connected Banks (view Cards from rival banks)

- Virtual Cards (Very useful for making safe payments with temporary details. You can generate up to 10, at a time, and remove [or not] whenever you like)

- Custom Categories (used to sort payments more clearly)

- 5% Interest on the Savings Challenge

- Billsback (A draw where you could get your Direct Debit paid for you)

Yeah, it would look pretty pathetic if the Bold ones were in Free, but, even those aren’t things I think most would use. Probably the coolest feature is Billsback, where every single Direct Debit payment you make has a chance (be it minuscule) of being paid for you by Monzo. Chance would be a fine thing.

Of course, all of these features simply grow the more you pay, which makes it pretty easy to work out the differences as we move up next to Perks.

Perks

£7 per month gives you, honestly, quite a lot of good

Perks gives you everything from Extra, but, so much more. This one, honestly, is actually worth it, for me and I’ve been using it for, well, over a year now. Pretty much every Bank has a plan around this much for their Debit Cards, but, they tend to throw in one good thing, then a bunch of nothing. I think Monzo Perks, really fits that balance of being worth it, for reasons you don’t have to forcibly stretch, too much, to feel worth it. For me, at least, it just simply is. But, I’ll let you judge for yourself in this additional features rundown;

- Instant Access ISA Increase to 3.25% (as of January 2026). Yes, if you’re Free or Extra, the ISA is a pitiful 2.75%. Although, if you compare to high street Banks, that’s rather competitive. If you move outside of that, it’s, certainly, not. One incredibly cool thing about how Monzo handle ISAs is that they’re built in to the App, not a whole new Account to separately manage. It’s crazy how this isn’t just the norm of how this is done. There’s also discounted Investment fees, should you use Monzo for that. Personally, I think Trading212 would be a better option.

- 3 fee-free Cash Deposits – One, pretty big, in my opinion, downside to using Monzo is when it comes to a Cash deposit. Withdrawals, no, no charges at all, unless ATM specific, or international above the limit. Deposits, though, you do. On Monzo’s free or Extra, you will get charged £1 for each Cash deposit into the bank. For those wondering, you add Cash to Monzo by using a PayPoint or Post Office. But, with Perks or Max, you can make three (personally, I think it should be more, or, unlimited) deposits for free.

- International ATM Withdrawal Limit Increase to £600 – For free and Extra Customers, you are limited to the value of just £200 should you use an ATM outside of the UK and EEA areas. But, with Monzo Perks, and Max, this increases to a much more reasonable £600. You will see a 3% fee, like with Free and Extra, if you exceed this amount.

- Annual Trainline Railcard – Depending on your eligibility for one, which, depends on Age, relationship and more, you can claim a free Railcard for as long as you’re a member of Perks, or Max. Or, you can save 1/3 on the other Railcards. Be aware, if you stop using Perks early, you may have to pay into the Railcard. If you never choose the Railcard, you don’t need to worry. Yes, by the way, you can cancel Extra or Perks at any time.

- A free Gregg’s per week – This is pretty awesome for me as I love a good Gregg’s. Yep, you can claim 1 free Sausage Roll, Sweet Treat or Regular drink with Monzo every single week. You will get a QR code you can use in any Gregg’s and, that’s it, you’re set.

- A free VUE Cinema ticket per month – With Hannah being such a Movie buff, this is also pretty awesome. What’s actually really good about the VUE Cinema Ticket is that it costs £8 to get a Ticket in Leeds, yet, Perks is £7 per month. So, if you look at it this way, we’re actually saving £1 by getting Perks. However, I’ve noticed some locations are cheaper Tickets, so, your Milage may vary. This, plus your free Gregg’s, though, kinda nice.

- Free Annual Uber One Membership – But, how you going to get to the Cinema, or, the Gregg’s, well, why not use Uber One. Yep, you can get discounted Taxi fees, or free Delivery on Uber Eats with a 1 Year Uber One Membership. Whilst this isn’t for me, Uber One is normally £4.99 per month or £49.99 per year, so, still a nice saving there.

- A new Card! – Yeah, it’s a small one, but, yeah you get a more reflective bold Orange Card, if you’re into that.

As someone who likes a Gregg’s, can see use in Uber every now and then, and, with the Wife liking Movies, tends to see one+ every month; Monzo Perks pays for itself. The added interest on my Savings is a really nice bonus and, believe me, that extra ATM allowance comes in handy when I’m in the Philippines, being, still, such a Cash heavy Country. So, for me, it’s a no-brainer.

Max

£17 per month is a steal, or, rip-off, depending on you

Whilst I think Perks, for the right person, is such a good deal, a Category which I fall into, Max is very specific. Max is all about Coverage, more specifically, Insurance. For that extra tenner, you get this;

- Worldwide Travel Insurance – This, by itself, for some locations, pays for itself, and it’s pretty decent Travel Insurance too. Covered by Zurich, you get Medical bills up to £10 Million, Trip Cancellation cover up to £5,000, lost valuables up to £750, winter sports, a Car hire excess waiver up to £3,000, and more. The excess for a general claim, too, isn’t that bad at just £50. Obviously shop around, but I think this is very decent cover for the very decent price.

- Worldwide Phone Insurance – I’m betting when you saw lost valuables before, you were thinking of your phone, well, don’t, you get that covered separately. Cover provided by Assurant. This Insurance can protect your phone and accessories from loss, theft and even accidental including cracked screens. What phones can you cover? Well, basically anything minus a Foldable as you get cover up to £2,000, plus £300 for accessories, such as Headphones, for example. Excess is sightly higher on this one, at £75, but, still pretty decent cover for no extra.

- UK & Europe Breakdown Cover – This one is a bit of an odd ball, but, I doubt anyone will say no to more stuff. With everything else feeling like a perfect Travel Card, for this one you’re limited to Continental Europe, which, yes, includes the UK. Provided by RAC, you’ve got Breakdown Cover included. This, by itself, can cost in the Regions of £5 – £9, depending on Car, so, again, a nice benefit. For me, not so much, as I’ve nothing to give it to, but, if you use all three, that’s when it becomes really worth it.

- Share Cover for £5 more, per person, up to 4 – This one’s a big one. So, you’re paying £17 per month for all the Perks features, plus Travel, Phone and Breakdown Insurance, but, what about anyone else? Well, if they’re in your Family, Spouses included, you can add anyone else for an additional £5 each. Yes, for an extra £5 per month, £22 for you, your Partner can get Travel, Phone and Breakdown Insurance, making this, all of a sudden, a very good deal. I’m using this with me and Hannah, for our Philippines Trip to save, but the idea that I could include my Parents in that same deal for an additional £10 for them, that’s when this becomes a Steal. BUT, there’s a * we’ll get to.

- A new Card! – Yeah, this is that darker one, this time. I think out of all of the Cards that Monzo provides, you’ll definitely not miss the Max one. Much more darker than the picture would lead you to believe, with the obvious change with the silver shining Mastercard logo. I have this, currently, and it definitely looks the best.

So, there you go, you see what I meant now by it’s a steal, or, a rip off, depending on how you use it. For me, I’m travelling somewhere where the cheapest Travel Insurance is around £70, so, it’s immediately cheaper to go Monzo Max. But, if you’re travelling, say, closer to home, it may not be. Though, if you include your Family in the cover, I’d, even then, find it hard to beat.

But, what about that *… Well, yes, there is one limit to Monzo Max, compared to the other Plans, and that is that you cannot cancel until 3 months in. This means that, yes, if you’re only going on a short Holiday and wanted this for Travel Insurance, then, yes, you’ll need it for 3 months before you can cancel. But, here’s the thing. For me, that’ll mean for me and Hannah, I’ll be paying £66 in three months. That is still cheaper than the Cheapest Insurance I can get just for myself, plus, I’m getting Phone Insurance for us both, and, I still have all the features of Perks I still use. Plus, when it comes to adding another Member, I challenge you to find Worldwide Travel Insurance, Worldwide Phone Insurance and RAC breakdown Cover all for £15 over 3 months.

So, yes, there’s a few drawbacks to Monzo Max, and, it really is a rare example of how it’s not always best to just pay all-in. But, if you need that Cover when it matters, it’s a fantastic option.

Monzo Flex

Completely free Credit card, with 0% over 3 months

Unlike the Paid and Free plans, this becomes a whole new Bank Account, so, whilst that might seem daunting, don’t let it, this is probably the best free you can get in its Category. This is, without a doubt, my favourite feature of Monzo, and, when used right, and you’ve learned all about it, could be yours, too. Monzo Flex is, to really simplify it, a completely free Pay Later Card, that still offers you all the benefits of paying with Monzo. This means, yes, you can pay with any Currency fee-free, yes you can still Split Bills and do all the others cool Monzo stuff.

In essence, yes, it’s a Pay Later card, with a cool darker design, and yes, it has some expectancies after that. But, to get this with, for example Barclays, you’d have to pay a monthly fee. Here, you don’t.

What’s my Credit limit?

Well, it depends. Whilst joining Monzo Flex is pretty painless, what you’re allowed to use is depending on, initially, your Credit Score, but, if used regularly reliably, your usage can lead to you having the option to increase.

The maximum Monzo will allow is up to £10,000. For anything more, you’re already in the territory of really needing to consider Loans or Mortgage, so, I think that’s a fair limit. Despite this, however, you may find when you first sign up to Flex, your Limit will be a lot lower, then, you’ll be offered a higher limit depending on how well you do.

Payment options

You have THREE Payment options with Monzo Flex, which are all, as the name would suggest, very flexible. You’re NOT committed to any option you choose, you can change anytime you please, and, as many times as you please, depending on how your Months are going, or, just by general preference.

Pay Next Month – A 0% option to pay for anything you make the next month. This is something I’ve been using alongside my Savings account by, essentially, using Monzo Flex all the time, then, paying off the Month at the end, whilst adding my entire Wage into a Savings pot. Pretty neat, right. But, of course, how you use this will vary. This is the Default option when you make your first Flex payment, but, you can change it to any of these.

Pay in 1, 2, or, 3 Months – Easily the best way to use Monzo Flex for more expensive purchases like Holidays etc, is utilising the Pay in 3. Why? Well, it’s still 0%. This means you can purchase a holiday on January 20th, and not fully pay for it until April. On this, however, it’s worth noting there’s a cut-off point, which important to note when making a payment as this will be covered from immediately next month, or, the one after. Again, you can adjust these at any time.

Pay up to 24 months – But, if Pay in 3 just isn’t enough, you do, actually, have the option to move up to 4 months, 5, 6, all the way up to a maximum of 24 months. However, this does come with a Penalty. Any Payback you choose to extend beyond 3 months will have an additional 29% interest added on to it. Monzo will make this very clear if you choose this, even showing you the addition that adds to each month. Plus, you can actually then SAVE interest by later on reverting back to within Pay in 3 timescales.

I think these offer, pretty much, a perfect setup and service and I’m a huge fan and user of this. It’s worth, also, pointing out, that there’s no mass agreement every time you make a Payment. You can use the Monzo Flex Card as your main Card and buy near-on anything, even use it with Apple Pay, etc. You can have as many Payments ongoing as you want, in any value that all collectively fall within your Credit Limit.

Some things, however, you cannot use Monzo Flex for, these are;

- Cash withdrawals of any kind*

- Purchases of Cash

- Gambling, betting, Crypto, you get the idea

For general purchases, though, from Shopping to a Holiday, it’s pretty damn good. Plus, it’s also a Credit Card, even if still Free, meaning that you can now actually take advantage of Section 75 protection for purchases within £100 – £30,000. My favourite thing about Monzo Flex is, honestly, it’s very transparent. There’s nothing hidden, it speaks for itself and, yes, you save if you pay early.

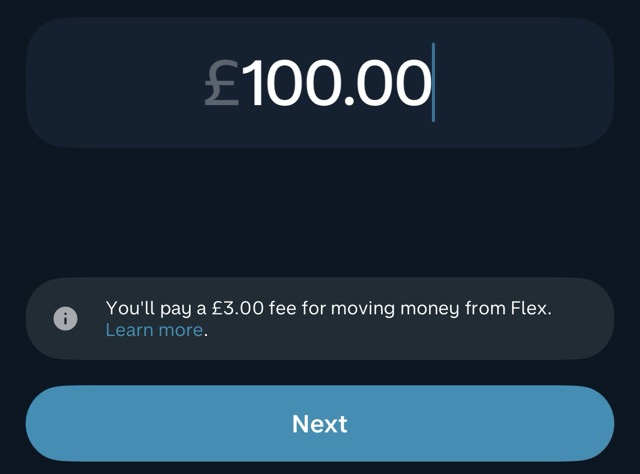

*”Move money”, can work from Flex to Personal, but, with a Fee

I did mention, however, that you can’t do Cash withdrawals, however, you can Move Money from your, up to £10,000, Flex pot, and add it to your Regular balance where, ironically, you could make a Purchase that returns to Flex. But, there’s a slight condition, that you’ll be charged an additional 3% fee. Although, I have to say, that’s not too bad, in reality. As shown above, you can type any Amount remaining in your Flex balance, and it’s very transparent how much it will actually take out, putting that 3% into consideration. In the most simplest to work out £100, example, you will lose £103 from your Flex balance.

If you can actually pay this back within 3 months, this is, actually, one of the cheapest ways to borrow money, in reality, as it’s only until you go past the 3 months where you’ll be back on the 29% rate.

!!! Only use if you can afford to !!!

As this is, technically, though, actually, also, officially, a Credit Card, even if the Card itself doesn’t cost anything to get and use, you are in a Credit agreement the moment you make any purchase. This means, unlike anything else I’ve mentioned as features of Monzo, you are liable if you miss Payments. Monzo Flex is, to be far, rather forgiving, and certainly very transparent, although, DO NOT test that.

The good news is that it’s very clear what you need to do and, whilst the Interest is pretty bad, compared to a Loan, for anything after 3 months, you can fall back on it if you have an unexpected challenging month. Just, always be aware.

Monzo Kids Accounts

Completely free, unlike most competitors, with full controls and monitoring which you’d expect.

If you ever make that unfortunate mistake in your life and end up with Kids stressing your life further than Marriage itself, then Monzo has an answer for you too. Any Parent can sign up their Kids under 16, from as young as 6, to have their own Debit Card.

For the Kid, they will use the Monzo app and see their Account in a very similar way as anyone else. For the Parent, they will use the Monzo app, and see, alongside their own, their Kids account too where they can monitor their Spend, add Limits and more, as well as easily transferring across.

As you can see from the image above, they have quite the bold colour options, able to choose either Pink, Blue or Yellow. Personally, I think they need to add more options as most of them are very girly, but, when you start comparing to other Big banks and their Fees fees fees, I think it’s a fair compromise. Kids can still use other features of Monzo such as creating Savings ISAs, limits, Freeze their Card in an emergency, all in a Bank which is still a FCA regulated Bank with FSCS protection as the Adults are.

Monzo Business

Available in flexible feature plans, including, yes, Free plans.

This is the only part of Monzo I’ve never, either, got involved with, or looked over, in person, so I can’t really comment much about Monzo Business Accounts, other than to just feature roll what it can offer. Monzo Business is rated number 1 by users in the bank survey on Service Quality overall.

Just like Personal Bank accounts, Monzo offer a range of different Categories which are anything from Free, to more.

Business Lite

It just works, so you can too. A free business bank account that gives your customers simple ways to pay, including in-person contactless card payments.

It’s quite rare for a Business Bank Account to be Free, but, Monzo offer quite a number of things for Free, though, most are rather basic. Instant Bank Transfers, ability to accept and make Contactless payments, Payment links, scheduled Payments, Deposit Cash and Cheques, International Payments (like Personal, these work through Wise), Digital Receipts, Tax Digital software, Insights, Web access*, Business Savings 1.3% AER up to £1M.

*It’s worth mentioning about Web access, by the way. If there’s one negative of Monzo, as a whole, it’s the lack of any real Web access. Most other banks allow you to access your Account from multiple devices, and your computer through the Web. With Monzo, you can’t. The lone exception to this, is Business, but, even then, it’s only for differing users or members within your Business.

Business Pro

For an additional £9 per month, Business Pro is when Monzo Business starts to act like a Business Account. You can now, like with Paid Personal Accounts, now use Virtual Cards, but you can also utilise Invoicing, which can include your Business logo and more in the Footer, fully customisable.

Pro now allows Team Access Levels, through Admin, Collaborator, but, this goes even further through Team account below under Expense cardholder

Pro is £9 a month, with the first month free trial.

Business Team

As mentioned before, you have an addition of Expense Cardholder on the Team access levels, but, of course, Monzo Business Team gives you all the features of Monzo Business, and, for £25 per month, it really should.

In addition to everything prior, you now have Expense Cards, Bigger team, as well as Bulk payments as a feature and Payment approvals.

Overall, from what I’ve seen from Business Accounts, Monzo probably isn’t the strongest outfit for Business, with the exception of if the Free, or Pro, is just about enough. This is very similar to Monzo Max, if it’s got what you need, it’s worth it, if it doesn’t, don’t bother.

To Summarise

It’s fair to say that Monzo has a lot to offer, but, let’s be real, which Bank doesn’t. I think what Monzo does better than others is it’s far more of a Personal bank, with many additional features that make it feel that bit more.

Does it the best Savings Rate? No. Does it offer the most features than others? No. We could go on. But, it does what it does in a very good way, providing a whole range of features that, if they work for you, like they all do for me, it’s one of the best Banks to use. Curious? Try it out, it’s free to try by clicking here!

FYI: Always have, more than one, Bank account.

Despite how much I think Monzo works for me, or, let’s be honest, how much any Bank works for you, one thing I recommend above anything else, is to make sure that you have more than one Bank account. Monzo, like all Banks, has downtime, outages, and, who knows, something could happen to your Bank account. FCSC protection is very helpful and a good insurance for this up to £120,000, but, when it comes to Savings accounts, very competitive, paying in Credit, very competitive, it’s always best to shop around. You, as a Tax payer, can have as many Banks as you want which will not impact your Credit Score.